The golden rule of estate planning is that after any major life event, your estate…

A Dumm Family Story About the Importance of Powers of Attorney

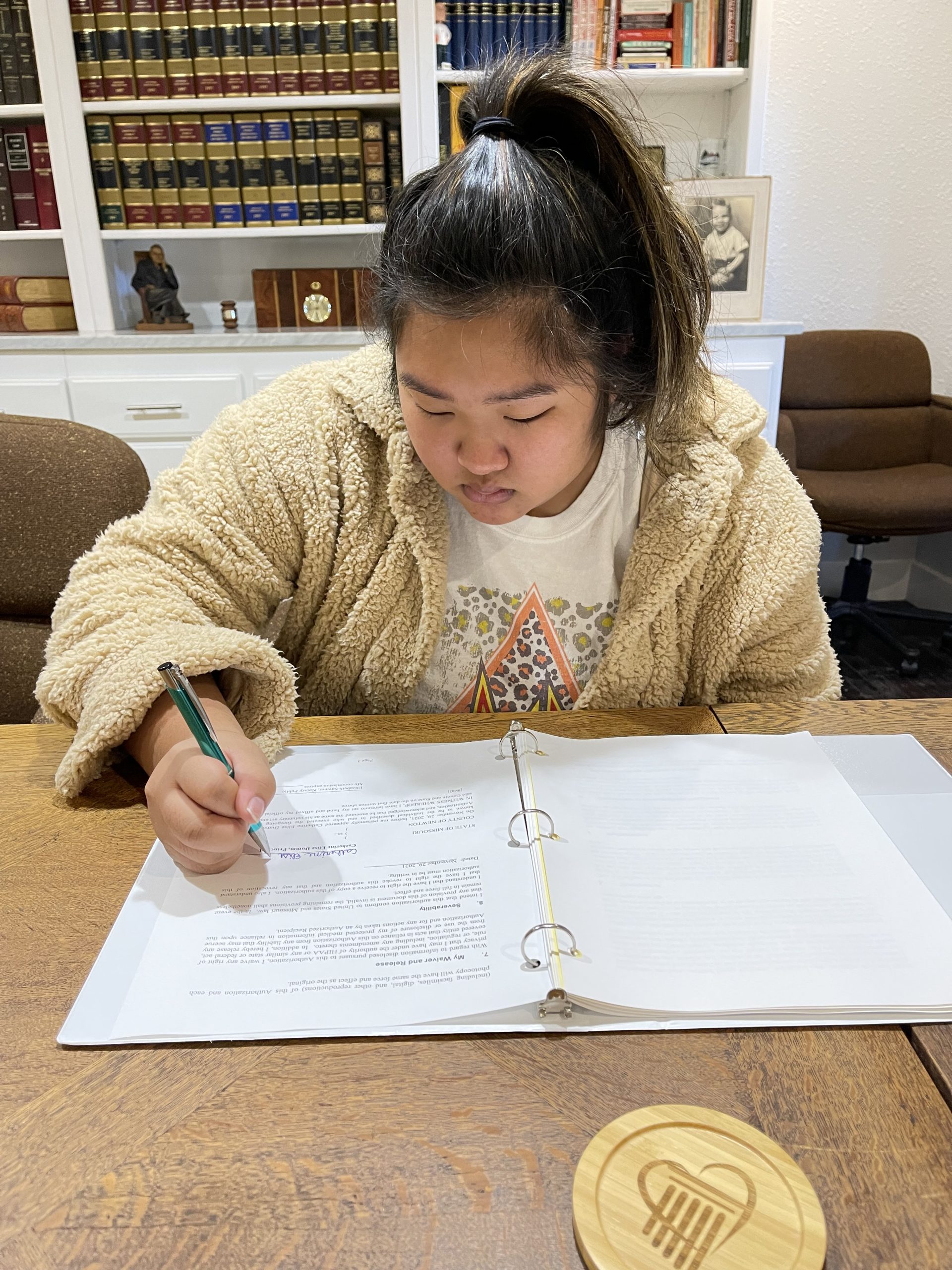

When you grow up with an estate planning attorney for a father, you don’t just celebrate gaining the right to vote when you turn 18, but gaining the right to control your financial and medical affairs, too. And what better way to do this than by signing your financial and medical powers of attorney as well as your HIPAA authorization? This is exactly what my daughter, Cate Dumm, did on the occasion of recently turning 18 and while doing so may not be the most glamorous act of celebration, it’s an important one that no family should overlook.

Why Were Powers of Attorney the First Thing on My Mind When Cate Turned 18?

Well before Cate turned 18 we had spoken about the legal responsibility that comes with reaching adulthood so she knew that shortly after cake we’d be sitting down to execute her powers of attorney.

Why the rush, you ask? Because I care about her and I know all too well what can happen when these crucial estate planning documents are overlooked.

Upon reaching the age of majority a young adult inherits the right to make their own financial and healthcare-related decisions. They also gain the right to control who has access to their medical records and who may intervene in their finances. This means that unless they grant you, their parent, explicit permission, you may not be able to come to their rescue should they ever require help. Powers of attorney documents and a HIPAA authorization resolve this worry.

How Do These Documents Work?

1. Medical Power of Attorney

Before your young adult leaves the nest and heads off to college or any other new adventure, you need to ensure they have executed a medical power of attorney. This document allows an individual to appoint an agent to make healthcare-related decisions on their behalf should they suffer incapacitating injury. If anything ever happens to your child, you won’t be able to view their medical records or intervene on their behalf without a medical power of attorney which is why signing one was among the first things Cate did upon turning 18.

2. Durable Financial Power of Attorney

Like the above, this document permits an individual to appoint an agent to act on their behalf although here, the powers concern financial instead of medical matters. Should your child suffer incapacitating injury, a durable financial power of attorney allows you to look after their financial needs. This involves the ability to pay bills, manage leases and utilities, file or defend against a personal injury suit, apply for public benefits, and take care of financial accounts.

3. HIPAA Authorization

The Health Insurance Portability and Accountability Act (HIPAA) is a 1996 law that obliges insurance companies and health care providers to protect the privacy of their patient’s health records. When your child signs a HIPAA authorization they grant you access to these records and thus the information you need to act in their best interest in moments of crisis.

Having powers of attorney and a HIPAA authorization in place means your child remains protected against unforeseen tragedy even if they are no longer your child but your young adult.

To learn more or to arrange to execute these documents today, do not hesitate to reach out to the Law Firm of Christopher W. Dumm either by calling 417-623-2062 or using the contact form on our website.

Contact the Estate Planning Attorneys at the Law Firm of Christopher W. Dumm