As a high net worth individual, you'll benefit from tailored estate planning to safeguard your…

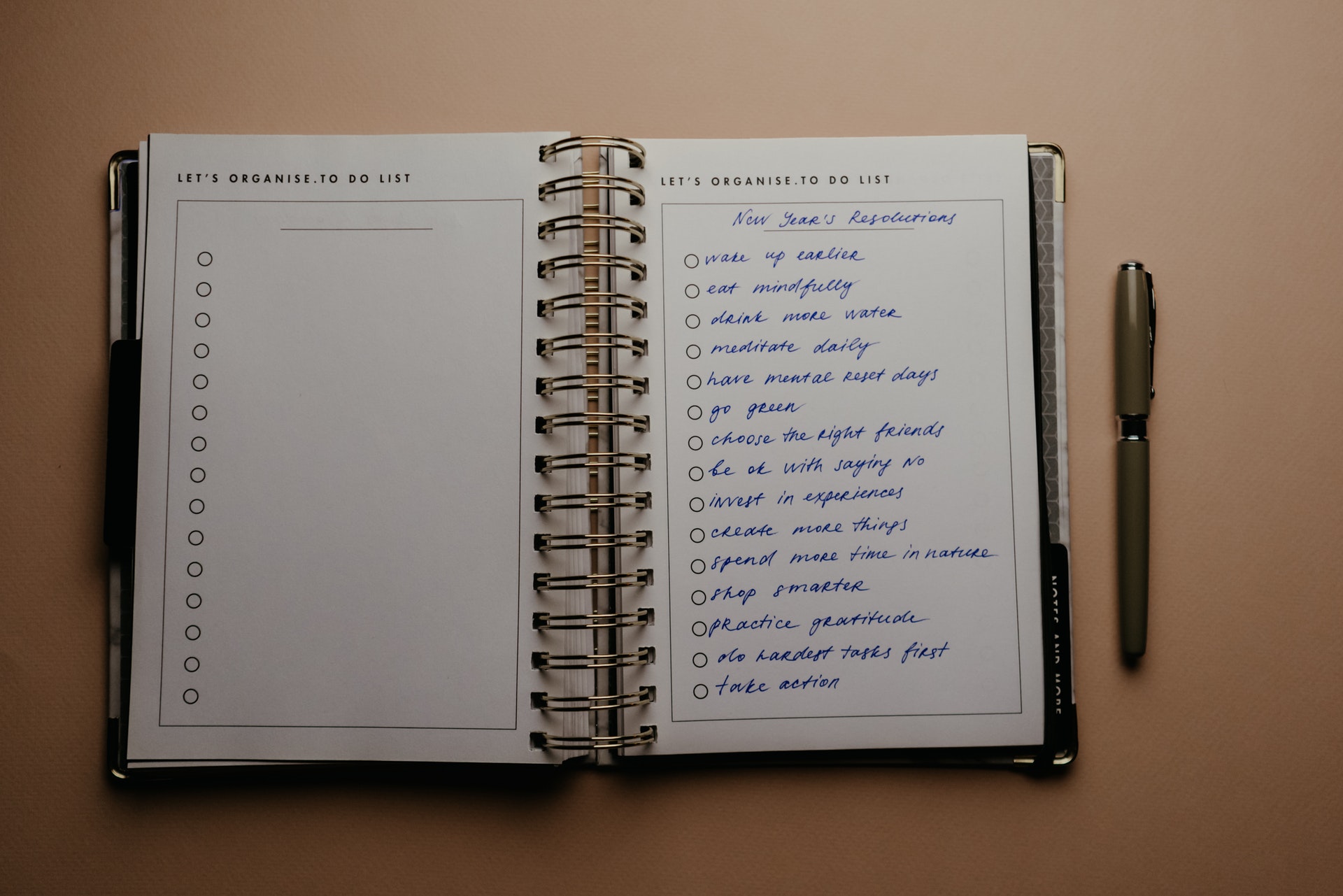

An Unconventional New Year’s Resolution and We Aren’t Talking About Exercise!

Oh, New Year’s resolutions… those pesky promises you make thinking they will improve well-being only to discover three weeks in that they just lower your self-esteem and leave you wondering about your willpower. If you haven’t been able to make it to the gym before work during the last twelve months (and who has?), what makes you think a “new you” will emerge after a glass or two of champagne on New Year’s Eve? If a nice dinner has never felt complete without dessert, do you really expect food to change all that much in 2022? Dessert has existed since at least the seventeenth century (thanks, France!) and unless you plan to go to bed at 8 pm, early-morning exercise might do more damage than good (sleep loss provokes weight gain and many other scary health outcomes).

Instead of setting a New Year’s Resolution that is just holiday joy-fuelled self-sabotage, commit to doing something you can actually achieve and will bring real benefit to your life. I am talking about estate planning. If this is the year you finally get your affairs in order, you won’t only benefit now and for the rest of your life but well into the afterlife, too. An estate plan ensures you are taken care of while living and your loved ones are cared for when you’re gone. A plan takes a short amount of time to set up and nothing more than periodic revision every few years, and updates along with any major life event. To learn about what you need to get started, read on!

Three Steps to Getting an Estate Plan Off the Ground

1. Take Stock of Your Assets

The first step to estate planning is determining the contents of your estate. This means making a list of all property, financial accounts, and vehicles as well as sentimental items and digital assets. In a world where lives are increasingly lived online, social media profiles, digital currencies, and virtual possessions such as non-fungible tokens (NFTs) have attained real value and so must not be forgotten as you tally your belongings.

At this stage in the planning process, it is also important to make note of dependants, special causes you wish to support, and any important passwords or log-in information.

2. Get Your Family Involved

Estate planning is not just about organizing your assets. It is also about assigning key roles to loved ones to ensure your finances and well-being are secure while you are still living. This means that before you can begin executing documents, you need to talk about who will serve as your financial and medical power of attorney and who is best suited to act as executor of your estate. Having these conversations also means talking about your estate planning priorities, goals, and wishes and so it is important to take a thoughtful, measured approach to the subject.

3. Find the Right Estate Planning Attorney

The right estate planning attorney invests in learning about your family and calls attention to any complications you may have overlooked. They will not only guide you through drafting documents when the time comes but will take care to ask all the right questions to ensure your plan meets you and your loved one’s needs.

To learn more about making a New Year’s resolution that you will not only stick to but which will benefit you for the rest of your life (and beyond), do not hesitate to reach out to the Law Firm of Christopher W. Dumm either by calling 417-623-2062 or using the contact form on our website.

Contact the Estate Planning Attorneys at the Law Firm of Christopher W. Dumm